What Is a Closed End Fund?

Closed ended funds are investment companies that pool the assets of investors. They are regulated under the Investment Company Act of 1940.

Closed-end funds trade on an exchange, like stocks, and their prices can fluctuate during trading. Their market price may be higher or lower than their net asset value depending on supply and demand for their shares.

Definition

Closed ended funds are investment companies that pool the assets of shareholders to purchase various securities. They’re regulated under the Investment Company Act of 1940 and may either be publicly traded or unlisted.

Contrary to open-end funds, closed-end funds do not issue new shares of stock after an IPO. Instead, investors buy and sell CEF shares through a secondary market on a stock exchange. As such, CEFs may trade at either a premium or discount relative to their underlying portfolio value.

Some factors that impact a fund’s price include its manager, the sector it invests in and investor sentiment. These reasons can drive share prices up for new investors or cause existing ones to experience losses, depending on which is more advantageous.

Another factor influencing a fund’s price is its use of leverage. This strategy involves borrowing money to purchase more assets, increasing returns in times of rising markets but magnifying losses when stocks are falling.

Leverage can also enable a fund to increase its dividend distributions to investors. As previously noted, leverage makes it simpler for the fund to earn more when its investments are rising; however, it may make it more challenging to distribute dividends when earnings are falling.

In addition to these factors, a fund’s performance can be affected by its holdings. For instance, if it holds too many bonds, interest rates on those securities could change and negatively impact the value of a fund’s portfolio.

As with any investment, closed-end funds can be risky. Before investing in a closed-end fund, you should carefully consider your investment objectives, risk tolerance and liquidity needs.

Though closed-end funds carry some risk, many investors have discovered they can provide an excellent opportunity for income generation. For instance, a closed-end fund that pays out a monthly dividend may be more tax efficient than an open-end mutual fund that doesn’t pay out any dividends. If you’re interested in exploring these possibilities further, connect with a financial advisor today!

Characteristics

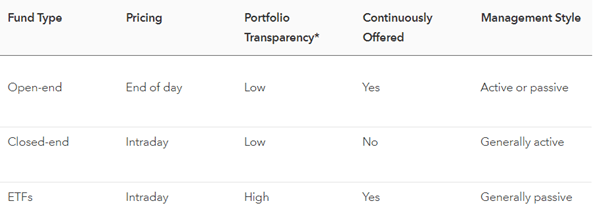

Closed ended funds (CEFs) are professionally managed investment companies that pool the resources of many investors to invest in a diverse portfolio of financial assets. CEFs differ from open-end mutual funds and exchange traded funds (ETFs) in several important ways.

Closed-end funds are traded on a stock market and can be bought or sold at any time during trading day. This gives them flexibility to take advantage of price changes, but also makes them more volatile than open-end funds.

Share prices for closed-end funds can fluctuate significantly based on supply and demand, investor perception of the manager, strategy, portfolio, and general market sentiment. During periods of market volatility, shares in these funds may trade at either a premium or discount to their net asset value.

Fund performance can be significantly affected by these discrepancies. Furthermore, closed-end funds often employ leverage which increases their net asset value volatility and associated risks.

Closed-end funds use different levels of leverage depending on their capital structure and regulatory limits. The two most common forms are structural leverage and portfolio leverage. Structural leverage occurs when a fund borrows to acquire assets for its portfolio; examples include bank loans, lines of credit, tender option bonds, reverse repurchase agreements, puttable preferred shares, mandatory redeemable preferred shares and extendible notes.

Closed-end funds have several ways to leverage their assets for increased returns to shareholders. These include convertible debt, preferred shares, equity-linked securities and derivatives.

In addition to using leverage, some closed-end funds pay a dividend that could aid in improving fund performance. These dividends are calculated based on the value of their shares and may be paid quarterly or annually.

Closed-end funds can be an excellent way to diversify your investments by spreading risk across various industries, sectors and company types. Furthermore, they offer more investment options than open-end funds which typically focus on stocks. Furthermore, some closed-end funds invest in less liquid securities like real estate, oil or gold that have higher liquidity risks.

Taxes

A closed ended fund is a type of registered investment company that invests in various securities. To operate effectively and abide by stringent antifraud regulations, the fund must meet certain operating criteria as well as be regulated by the Securities and Exchange Commission (SEC).

Closed-end funds primarily consist of equity-based and bond-based closed-end funds. Assets in both types have seen significant increases over the past year, representing 61% and 60% respectively of total closed-end fund assets.

Share prices for closed-end funds are determined by supply and demand, as well as the expertise of a professional fund manager. These shares trade on an exchange like shares of stock, with investors choosing how much to pay for them depending on how much interest is paid by the fund to its underlying issuers.

Dividends received from a closed-end fund are generally taxed to investors as ordinary income. Furthermore, capital gains and returns of capital from selling securities held by the fund are taxed at long-term capital gain rates.

Distributions are typically made on a monthly or quarterly basis and may be adjusted or increased from one period to the next. Depending on a closed-end fund’s underlying holdings, these distributions may include interest income, dividends or both.

Some closed-end funds use managed distribution policies to guarantee common shareholders a consistent cash flow distribution over an agreed upon period. These are commonly employed by multi-strategy or equity based closed-end funds and they must adhere to regulations set forth under the Investment Company Act of 1940.

Effective managed distribution policy necessitates that the investment strategy of the fund be well-diversified across markets in which it invests. Furthermore, the portfolio should be designed with minimal risk and maximum returns in mind.

Another crucial consideration when investing in a closed-end fund is the type of leverage used. Leverage can assist a fund in achieving higher long-term returns, but it also increases risk and volatility in share prices.

Closed-end funds are best handled by a professional who understands your time horizon and risk tolerance. A knowledgeable advisor can make recommendations that fit within your individual objectives, as well as explain the intricacies of these products to you.

Fees

Closed-end funds are investment companies that pool money from investors to purchase securities or other assets. While they invest in various investments, most closed-end funds are bond funds which use leverage to boost returns.

Similar to mutual funds, closed-end funds employ professional managers who construct and manage their investment portfolios according to the fund’s goals and objectives. Unlike open-end funds that issue new shares when they sell, most closed-end funds issue a fixed number of shares that investors can trade on the open market.

The price at which closed-end fund shares trade fluctuates throughout the day, depending on supply and demand. Sometimes, shares of these funds trade at either a premium or discount to their net asset value depending on several factors.

Investors can purchase closed-end fund shares through a broker or an exchange that deals in the stock of such funds. The price of shares is determined by several factors, such as fund manager popularity, the sector a fund is focused on, and when new fund information becomes available.

Some opportunistic closed-end fund investors can purchase shares on the secondary market at discounts to their net asset values, particularly during times when prices are low.

Fees and expenses should also be taken into account when evaluating closed-end funds. They can reduce your return on investments in the fund as well as impact how quickly distributions are paid out.

When a closed-end fund pays out distributions, it must provide you with written notice outlining the sources of funds it is drawing upon to pay them. This notification, known as a 19(a) notice, is mandatory under the Investment Company Act of 1940.

You should read the fund’s prospectus, most recent annual report and company announcements to gain insight into its investment strategies, risks and proposed sources of distributions. Furthermore, take a look at the fund’s investment portfolio and how it has performed over time.

Some closed-end fund distributors include a distribution rate in their brochures or website, but this doesn’t guarantee payment from the fund’s income. It could come from returns of principal or capital gains instead.