What Are RSU Grants?

Restricted stock units (RSUs) have become an increasingly popular type of equity compensation within the tech industry, making up up to 50% of total annual pay in some cases. Therefore, understanding how RSUs function is essential for any employee who wants to maximize their rewards from a company.

Like stock options, RSUs are granted with a vesting schedule and usually subject to ordinary income taxation. They may also qualify as long-term capital gains if held for at least one year after they have vested.

What are RSUs?

Restricted stock units (RSUs) are shares of your employer’s company stock that you receive as part of a compensation package. Generally, they are valued at their current price on the date of grant and then vest over time.

Once you meet the vesting requirements and other conditions, however, those shares become yours – they can be kept or sold as desired. Please be aware that this could result in tax implications.

After your shares vest, any gains (or losses) are taxed at your ordinary income tax rate. However, if you keep them for one year or longer, any growth in value is taxed as long-term capital gains at a preferential rate.

Though you may be content to have a large portion of your wealth tied to the success of your company, it’s essential to factor in the risk that the value of those RSUs could go up or down over time — or even decrease altogether. As such, have your financial planner review your strategy and decide when and how best to exercise those RSUs.

How do RSUs work?

RSUs (Retained Stock Units) are a form of equity compensation that permits your employer to award you with shares of company stock at some future date. Usually, these stock awards are based on performance or service and vest over multiple years according to an established vesting schedule.

Although a single RSU may seem complex in isolation, it’s essential to consider it in the context of your overall investment portfolio. RSUs can be an excellent tool for diversifying investments and helping offset taxes if you’re maxing out your 401(k) or other tax-deferred accounts.

Once your shares vest, you have a wide range of options to use them for other goals such as funding your retirement account, paying down debt or funding your house down payment. In certain circumstances, you may even be able to sell them in order to fund charitable giving initiatives.

What are the tax implications of RSUs?

RSUs (Real-Time Uncertainties) are a form of equity compensation that may be taxed differently than other company stock. They’re usually subject to ordinary income and payroll taxes, as well as being taxable upon sale.

Due to this, startup founders and employees often need to prepare for their tax situation when they receive a large number of vested RSUs in one year. This could be an advantageous time to consider deduction bunching, an effective strategy which increases itemized deductions in one year while decreasing your overall tax bill.

RSUs are typically vested according to either a regular vesting schedule or performance benchmarks. These dates should be clearly specified in both the grant agreement and employee’s job description.

How do I exercise my RSUs?

Receiving stock options or restricted stock units (RSUs) can be an exciting milestone, but to maximize your equity compensation opportunities and understand their tax ramifications, careful planning is necessary.

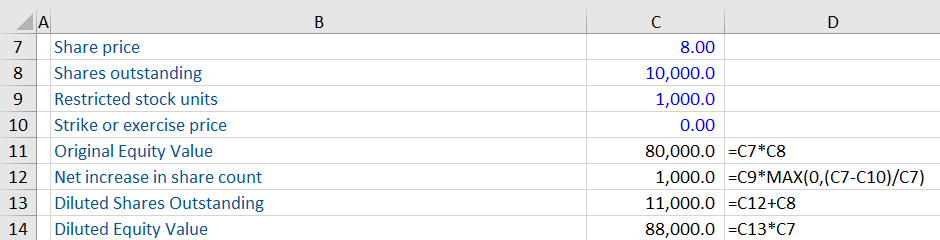

RSUs often come with time or performance vesting provisions that must be fulfilled before employees receive shares. This allows companies to offer an incentive without diluting ownership before the share grant has vested.

Similar to stock options, RSUs typically vest over several years. At the beginning of your employment, you will receive a certain percentage of the grant and another fraction each month until all of it has vested.

RSUs are treated as cash during their vesting period, with the company withholding part of their value to pay income taxes. Once vesting occurs, however, they become income and you can keep or sell them at any time; however, this also subject to capital gains taxation.