What Happens to Bond Funds When Interest Rates Rise?

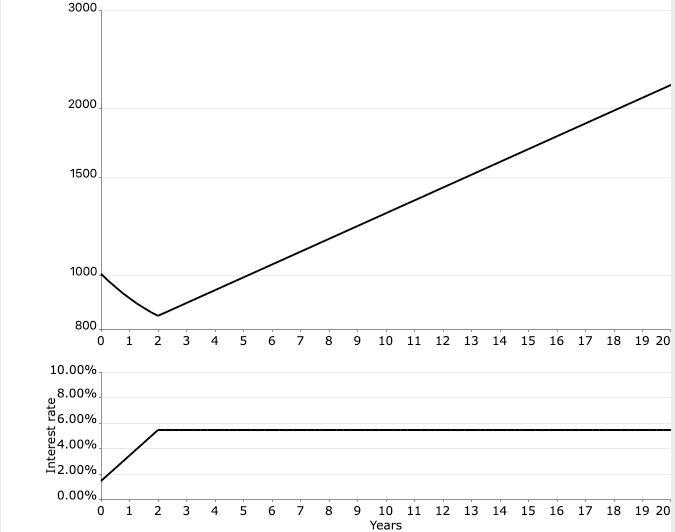

Interest rates rising often lead to a drop in bond prices and bond fund share prices, since bond prices have an inverse relationship with interest rates.

Interest rates rise, existing bonds must reduce their prices to allow issuers of newer securities to offer higher interest payments. Investors want to replace older, lower-yielding bonds with new, higher-yielding ones in order to take advantage of higher yields.

Increased Interest Rates

Interest rates rising can cause the market value of bond funds to decrease, as they are inversely proportional to bonds’ prices.

Interest rate hikes can be beneficial to bond funds in the short term, as they provide them with extra income. Furthermore, they make it simpler to reinvest your money into new bonds offering higher yields, thus increasing your portfolio’s overall return.

Rising interest rates can enhance a bond fund’s distribution yield by raising the coupon rate on its underlying bonds. This is particularly advantageous for funds that focus on non-investment grade corporate bonds, whose yields have seen an increase of 2.4% in just the past few months.

However, a rising rate environment can be detrimental for some high-yield bond funds as it will drive down the prices of older bonds in their portfolios. This is especially true for callable bonds – securities which may be called at par.

Due to the potential risk of declining investment prices due to call provisions, some bond funds opt to exclude them from their portfolios. On the other hand, those that take time to replace older securities with more recent issues will earn additional income through reinvestment of profits.

Bond funds offer another advantage by investing in various types of bonds, making them more diversified than other investments. Not only does this provide you with a steady income stream, but it may also shield your portfolio from market volatility.

Bond funds that invest in longer-term securities (e.g., 30-year bonds) have been more heavily affected by interest rate hikes this spring; however, they remain less volatile than shorter-maturity funds.

As with any asset, there are ways to protect against interest rate changes. Speak with a financial professional for more information about how this can be done. Bonds play an integral role in any portfolio; thus, understanding their behavior during times of change in interest rates and how it may help meet your objectives should be taken into consideration.

Higher Interest Payments

Interest rates rising lead to bond prices decreasing as investors become unable to purchase them at their current values. The price decline is dependent on a bond’s maturity and the size of its interest payments, known as “coupons.”

A bond that pays 4% of its principal annually is worth less than one paying 7%, as investors cannot purchase the lower-yielding bond at its original value, making it more appealing to purchase a recent issue with higher interest payments.

Similar issues arise with certificates of deposit (CD) accounts. Investors who can afford higher-rate CDs will sell their older ones and purchase the new ones. Savvy CD holders may opt for shorter maturities in order to protect themselves against falling prices caused by rising rates.

Investors with a longer-term perspective should view rising interest rates as an opportunity to boost their income and total returns by structuring their portfolios correctly. That requires designing bond funds with an appropriate maturity structure, or “duration.”

Short-term bonds typically experience smaller price decreases than long-term ones since they can be quickly replaced by newer options as their maturities come due. However, intermediate-term bond funds are more vulnerable to interest rate and inflation changes, which may lead to falling prices.

Investors should hold a variety of bond funds, each with its own maturity structure. In addition to investing in long-term bonds, they should also look for funds that invest in “inflation-protected” bonds or other fixed income securities that provide protection from inflation.

Finally, investors may wish to consider “short-term” bond funds with maturity periods of one to three years. While these funds may not be as well positioned to benefit from interest rate increases as intermediate-term funds since their maturities may be shorter, they still provide valuable diversification benefits when markets experience volatility in the short run.

Bond investors should aim to maintain a mix of short- and intermediate-term bonds in their portfolios in order to take advantage of higher interest rates’ increasing ability to pay out higher amounts in interest. However, this can be quite complex; thus, seeking professional assistance before investing in this area is recommended.

Decreased Prices

If you own bonds or invest in a bond fund, you may be concerned about what will happen to your funds when interest rates rise. While higher rates can have an adverse effect on fixed income investors, they also provide an opportunity for higher returns as coupon payments increase over time.

A rising interest rate can have several detrimental effects on a bond portfolio, such as increased credit risk, decreased prices and lower payments from the government. However, if your investment strategy has been built around bond duration and you have sufficient time horizon for reinvesting dividends and making only modest withdrawals, rising rates can actually enhance overall fixed income returns.

Bonds can be an important asset in your investing strategy, whether you’re searching for income, diversification or a combination of all three. They are low-risk assets that provide consistent earnings and tend to be less volatile than stocks over the long haul.

The market value of a bond is determined by its interest rate, which in turn depends on the national interest rate. If an upcoming bond offers a higher rate than this one does, investors will likely find it more appealing.

As interest rates are expected to be raised soon by the Federal Reserve, existing bonds must be discounted in order to remain competitive with newer issues on the market. This could cause bond prices to decrease sharply since existing issues won’t have enough space in their pricing to match what’s offered in the newer offerings.

Interest rates can also impact a bond’s market value by raising its yield, or percentage of interest it pays out. For example, consider an example with a 3% interest rate and 10-year maturity date; when interest rates go up, its price will decrease since that 3% yield no longer appeals to potential buyers.

Non-investment grade corporate bonds may also experience increases in yields. For instance, the non-investment grade corporate bond index saw its yields increase 2.4% this past few months.

Defaults

Interest rates rise and bond funds tend to decline in price. But this can be beneficial for long-term fixed income investors since it means higher total returns (income plus price appreciation) over time.

Bond values may suffer if the issuer of the bond fails to make interest payments or repay principal when due. A default will likely cause lower prices for bond funds, particularly long-term investments with high quality securities.

Fortunately, credit risk is low for most developed-market government bonds and investment-grade corporate bonds. On the contrary, some other types of bonds carry higher credit risks such as high-yield corporate debt or lower-rated government and municipal bonds.

A bond’s credit rating is determined by an analysis of many factors, such as the issuer’s underlying financial strength, willingness to pay interest and principal, any collateral it may own, and how this debt may impact other obligations on a company’s balance sheet. These elements are constantly shifting which could alter an issuer’s credit rating and consequently affect bond prices.

The credit risk of a bond can fluctuate over its life as credit rating agencies regularly assess the issuer’s financial health and reevaluate the rating. This could result in credit downgrades, leading to decreased bond prices as more investors become concerned about the issuer’s ability to fulfill obligations.

Another factor that could increase credit risk is an increase in borrowing costs, which may prompt the issuer to default instead of refinancing at a lower rate. This is especially true for companies reliant on debt for operations, such as utility or healthcare services providers that rely heavily on debt financing.

Bond defaults are uncommon and usually resolved amicably between the issuer and bondholders. Usually, defaults are restructured with bondholders receiving either a new bond or other form of recovery proceeds. Depending on the circumstances surrounding the default and issuer, this process may take months or years depending on its resolution.