What Happened to Vanguard STAR Fund (VGSTX)?

Vanguard STAR Fund (VGSTX) seeks long-term capital appreciation and income. It invests in a diverse group of other Vanguard mutual funds.

It has a balanced portfolio consisting of 60% to 70% stocks and 20% to 30% bonds, as well as some international stock funds.

What Happened?

Vanguard star fund has been around for some time and it remains one of the most popular balanced funds on the market. This fund invests in a diversified portfolio of other Vanguard mutual funds, both stock and bond funds included.

The fund seeks to assist investors in growing their money while decreasing volatility. It has had a consistent performance, boasting an average annual return of 6.3% over 15 years.

Retirement investors have consistently ranked this fund as a top pick. Additionally, its three and 10-year returns rank within the top quarter of similar balanced funds.

Furthermore, the fund charges an expense ratio below the industry average and does not charge 12b-1 fees or sales loads. This makes it a suitable option for those who want to minimize costs, particularly if they only have limited funds to invest.

Vanguard has been around for some time, but it’s not the only provider of index funds. Many rivals, including Fidelity (FIDE), have managed to stay competitive by offering comparable products at lower costs than Vanguard does.

As a result, competition is driving down index-fund costs more and more frequently. Vanguard must cover both its technology investments as well as its own operating expenses to remain competitive.

Vanguard must constantly offer investors new and creative investment options to stay ahead of the competition. That includes creating low-cost funds with a diverse selection of options available.

To achieve these objectives, the company must continuously seek ways to reduce expenses and upgrade technology. This can be accomplished through various approaches such as decreasing trading fees or introducing new strategies.

Due to this abundance of affordable and high-quality mutual funds, investors have an array of choices. Here are nine of the best options:

Target retirement funds of the company reduce your risk over time, while LifeStrategy funds provide a predetermined mix of stocks and bonds. Both these options are ideal for young investors with limited resources to invest in, since they enable you to select an allocation that automatically rebalances itself over time.

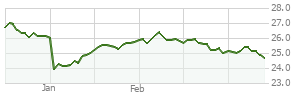

Performance

The star fund has been an outstanding choice for long-term retirement investors. It has been at the top of its category for 15 years, boasting average returns of 6.3% per year; further, it outperformed its peers over both three- and 10-year periods.

The fund’s investment strategy utilizes a balanced mix of stocks and bonds, helping to reduce volatility and boost portfolio diversification. Furthermore, it offers current income as an additional benefit that may help keep expenses down as you approach retirement age.

Vanguard STAR Fund is an ideal option for investors seeking a diversified, low-cost asset class. Its asset allocation is balanced and its distribution yield is competitive with similar funds.

It is essential to remember that stock-bond funds are subject to both market risk and asset allocation risk. Furthermore, a significant portion of their assets will be invested in bonds, which may present higher interest rate risks than investing solely in stocks.

Recent strength in the bond market should serve as a reminder that changes to interest rates could cause losses for portfolios. Furthermore, it’s possible that funds could experience losses if their bond exposure proves too aggressive.

In addition to the Morningstar Analyst Rating, fund performance data is also evaluated based on risk-adjusted return measures. A star rating is given to funds with at least three years of track record and its performance rated using a weighted average of its 3-, 5-, and 10-year risk adjusted returns.

This measure takes into account variations in a fund’s monthly excess performance, without taking into account sales charges, and assigns a star rating to each fund that meets or exceeds this metric. Ratings are assigned on a scale from one star to five stars, with five stars representing the best performance.

The Star Fund is managed by Vanguard Equity Index Group, which specializes in creating index equity portfolios designed to achieve high correlation with target portfolio benchmarks. Joseph Brennan oversees equity investments while Mortimer Buckley handles fixed income strategies for the fund.

Expenses

Expenses are an integral factor when selecting a fund. They can determine whether it will be profitable in the long run or not, and they may impact your tax bill if you invest in a taxable account.

Fortunately, many funds offer low expense ratios and don’t charge commissions or other sales fees. Therefore, they may be an attractive option for investors looking to save for the future.

However, it’s essential to recognize that not all funds are created equal. Some have higher expense ratios than others – for instance, some bond funds have higher expense ratios than stock funds.

It’s essential to evaluate a fund’s total gross expense ratio, which includes both management fees and operating expenses. Generally speaking, funds with high expense ratios should be avoided since they can accumulate rapidly over time.

Vanguard STAR Fund boasts a relatively low expense ratio: its shares cost just 0.34%, which is less than half the average among balanced funds. Furthermore, there are no sales load or purchase fees, plus there are no ancillary charges such as 12b-1 marketing fees or account service fees for accounts with balances under $10,000.

It’s essential to remember that expense ratios don’t include transaction costs – which are charges when a fund buys and sells securities. These fees can have an immense effect on an investor’s performance as well as their taxes.

Another aspect to consider is the portfolio turnover rate, which measures how often a fund sells securities in order to buy more. The higher this figure, the greater the transaction costs and could negatively affect the fund’s performance.

It is essential to recognize that stock and bond markets can fluctuate according to changing market conditions, making it difficult to accurately forecast how an investment will perform. This is particularly true for retirement accounts, which typically have longer time horizons than other investments.

Taxes

Vanguard is a well-known mutual fund company that offers over 100 index funds and ETFs with low minimum deposits. Additionally, it’s one of the leading providers in tax-advantaged accounts such as IRAs and Keoghs.

For instance, Vanguard STAR Fund allocates 60% of assets to equity stocks and 40% to bonds – an asset allocation which has been proven to be a major driver of capital gains distributions.

Table 5 highlights the fund’s history of qualified dividends and capital gains distributions. During its early years, which coincided with a long bull market, it distributed substantial taxable capital gains.

The fund’s underlying portfolios also suffered losses during bear markets, helping to reduce taxable capital gains distributions. This was a common strategy among active funds.

Furthermore, the fund held a low treasury bond allocation that allowed it to claim the state income tax exemption associated with such interest. This helped mitigate its taxable exposure and, as of 2010, could also help mitigate any foreign tax credits received.

Another factor that may help minimize a fund’s tax liabilities is how it is managed. For instance, Vanguard STAR Fund offers high-yielding, actively managed investments designed for retirement accounts such as IRAs and Keoghs.

One of the unique characteristics of this fund is its use of “heartbeats,” or large and frequent transactions in and out of an investment. According to Vanguard data, these heartbeats have totaled approximately $20 billion over seven years – more than regular stock withdrawals!

Although this amount may seem small for a large mutual fund, it accounts for an important portion of its taxable assets. As a result, some shareholders of the fund received large capital gains distributions.

Unfortunately, many investors ended up facing crippling tax bills that could have been avoided had their funds been held in a tax-advantaged account. While it’s common for small investors to make costly mistakes, larger investment firms tend to fail at helping their clients avoid such issues.