What Are Bond Funds?

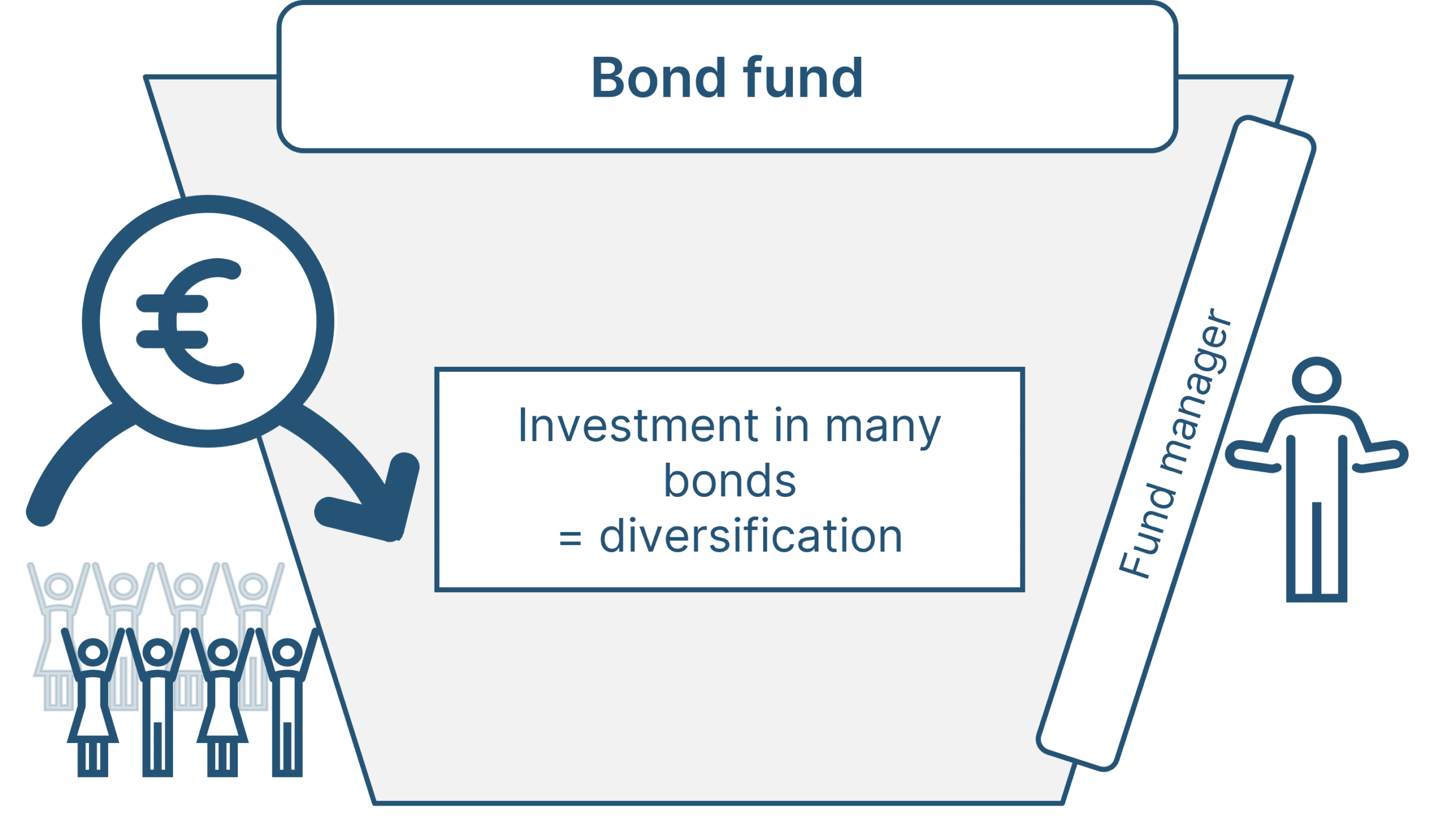

Bond funds collect money from investors with the aim of creating an income stream by investing in a portfolio of fixed-income securities. Unlike individual bonds, these funds pay out dividends periodically and don’t have a maturity date.

Bond funds, like other mutual funds, possess certain investment risks which should be carefully taken into account. These include credit risk, interest rate risk and prepayment risk.

Diversification

Diversification is the practice of spreading your money among various investment instruments and asset classes, which can help limit losses and smooth out fluctuations in investment returns.

Diversifying in the bond market means selecting from a wide variety of sectors, industries and market regions. Likewise, investing in companies of various sizes and locations may also be part of diversification.

Bonds may be seen as less glamorous alternatives to stocks, but the bond market offers investors a growing selection of solutions that can provide them with income and capital preservation.

A well-diversified portfolio of bonds may help to mitigate volatility in your equity investments. Bonds in particular could provide a valuable protection against stock price declines when inflation is rising and interest rates are high.

Diversifying can reduce the risks of overconcentration in one industry or region, or even company. General Electric used diversification to expand their business by acquiring operations across various sectors like aeronautics, rail, power plants and gas.

Income

Bond funds typically invest in a wide selection of bonds with various maturity dates, coupon rates and credit ratings. Furthermore, they make periodic interest payments to investors based on the bonds held within the fund.

When determining if an individual bond or bond fund is the better choice for you, take into account your financial objectives, behavioral preferences and tax situation. Bonds offer predictable income with known values at maturity; on the other hand, bond funds provide greater diversification and professional management.

Bond and bond funds offer various advantages, yet both are subject to certain risks. These include interest rate risk, credit risk and country/regional risk.

Investors should focus on the total return when assessing bond funds, which includes both interest income and price gains or losses from underlying bonds. This daily total return should give them a reliable indication of how the portfolio performed over an assigned period.

Taxes

Bond funds are investment companies (mutual fund, ETF, closed-end fund or unit investment trust) that invest primarily in bonds. Depending on its investment objectives and policies, the fund may invest primarily in government bonds, municipal bonds, corporate bonds or a combination of them.

Taxable bond funds that hold government bonds typically do not need to pay federal taxes in the year they are earned.

Capital gains on individual bonds are usually taxed at the investor’s marginal rate; however, some investors may qualify for a lower capital gains tax under what is known as the de minimis rule.

Individual bonds can be a good way to diversify your bond portfolio, but they also carry risk and require time-consuming research. On the other hand, bond mutual funds provide diversification without needing the same level of effort. These professionally managed investments offer professional management and generate both short and long-term capital gains that are taxable.

Volatility

Volatility is a measure of how much market prices fluctuate in either direction over an extended period. When an asset’s price is more volatile, it indicates greater uncertainty regarding its future prospects.

Volatility can also serve as an indication of how risky an investment might be. For instance, assets with high volatility may be more sensitive to changes in interest rates than ones with low volatility.

Bond funds are exposed to various risks, such as interest rate risk and credit risk. These potential dangers include the possibility that a bond issuer won’t pay interest or principal on time, or negative perceptions about their capacity may cause the bond’s price to decrease.

The longer a bond’s remaining term, the more susceptible it is to changes in interest rates. Therefore, it’s essential to analyze the duration of a bond fund’s portfolio when investing.